What 60 Condos Tell Us About Condo Fee Increases in 2023

Last year, we launched our inaugural report on condo fee increases, which garnered significant interest and attention in the condo industry. This year, we are delighted to publish our second annual report, and have expanded our report to also showcase budget impacts on additional expense categories. We believe that the insights in this report will help managers to better communicate budget increases to their stakeholders, which is more important than ever during these dynamic economic times.

This year continued to see elevated levels of inflation not seen in decades. At the time of this report, headline consumer inflation rose 3.8% year-over-year, with food inflation still high at 5.9% year-over-year. While some of the underlying components of consumer inflation certainly feed into condo costs, as you will read in this report, condos are generally beholden more to professional services and residential building construction related inflationary pressures, which have grown at a more accelerated rate since the pandemic.

We have written this report to share with managers trends we have seen in condo budgets in 2023. We hope that this data will help to inform property managers on important considerations when preparing their budgets this year. We also intend for this report to be helpful for educating boards and owners on what is driving budget increases in 2023.

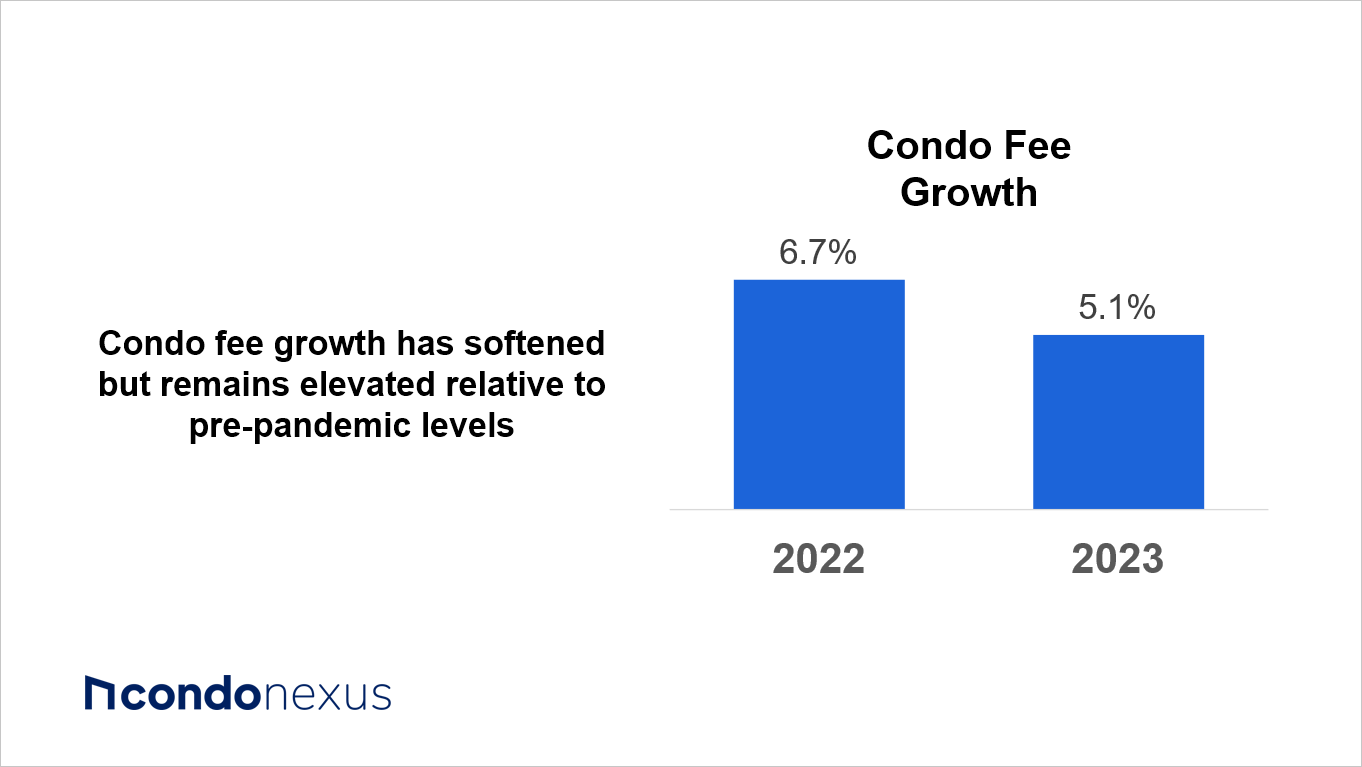

Condo fee growth remains elevated relative to pre-pandemic levels

Our analysis involved the review of an anonymized set of 60 condo budgets in 2023. The set of condos analyzed included townhouse, low-rise and high-rise condos spanning Toronto, Halton and Peel region with ages ranging from 1 year old to 36 years old.

Our study found that condo fees increased by 5.1% on average so far in 2023. This number is above consumer inflation growth, as we would expect since condo fees are driven more by professional services and residential building construction related costs. These latter costs have seen significantly elevated inflationary pressures, with residential building construction prices having increased by 51.5% over the last three years. However, relief may be on its way, as a 6.0% year-over year growth in Q3 2023 suggests that growth in these costs may finally be cooling.

This report will cover key components of condo budgets such as reserve fund allocations, gas, contract services, management fees and insurance premiums. As you will see, these individual components of the budget have shown remarkable trends that have varied greatly compared to the overall average growth of condo fees.

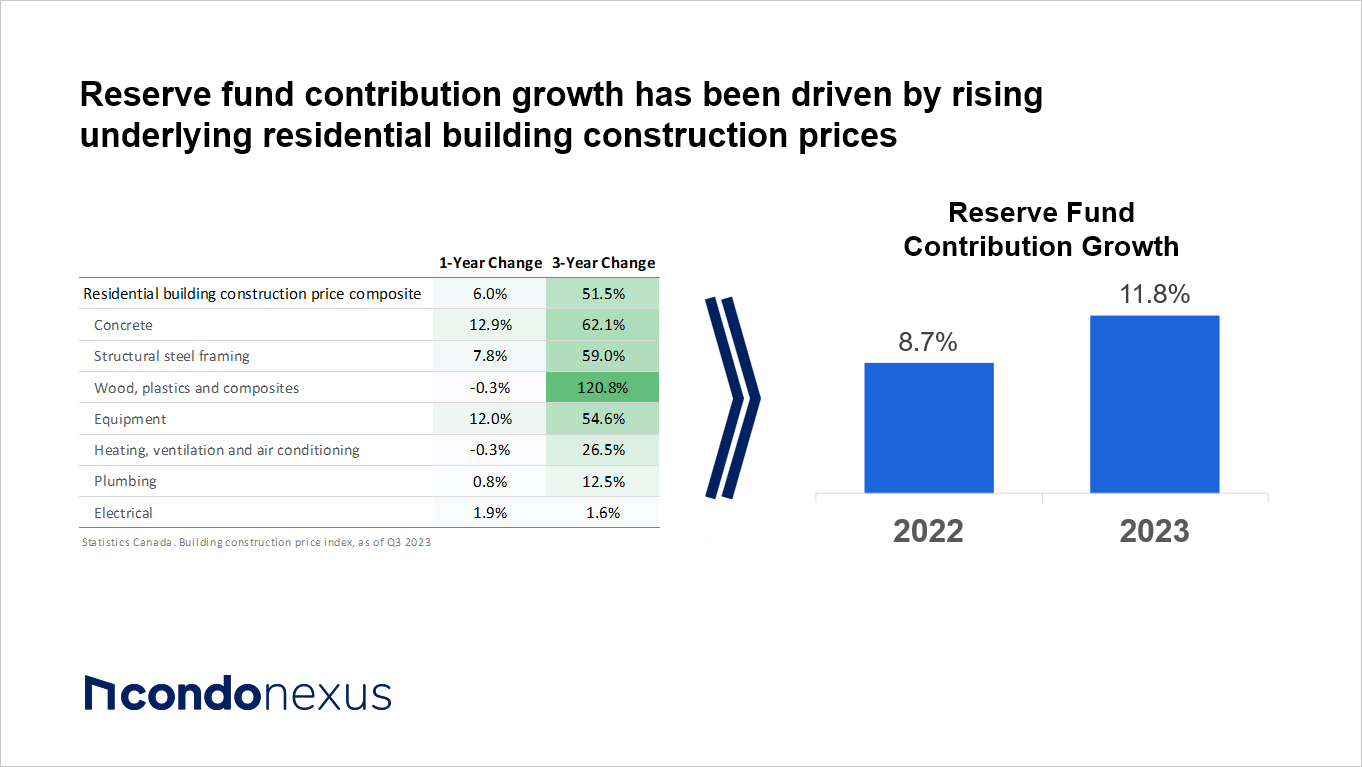

Reserve Fund Allocations Rising as Building Construction Prices Soar

Our analysis found that allocation to the reserve fund on average increased by 11.8% across the condos studied, which is further underscored when understanding that reserve fund allocation was on average 25.6% of an average condo’s budget.

Reserve funds are savings set aside for paying major future repair and replacement costs of common elements. Over recent years, many condos have required increased reserve funding due to having previously underfunded reserve funds, something which continues to affect the condo industry. Moreover, during the pandemic, soaring residential building construction prices have also caused future reserve fund spending requirements to increase, requiring condos to further top up their reserve funds.

In fact, we believe that some condos have yet to see these higher costs reflected in their reserve fund projections. Reserve fund study updates normally take place every three years, and as condos begin to update their reserve fund studies, we may see a further bump in reserve fund allocations.

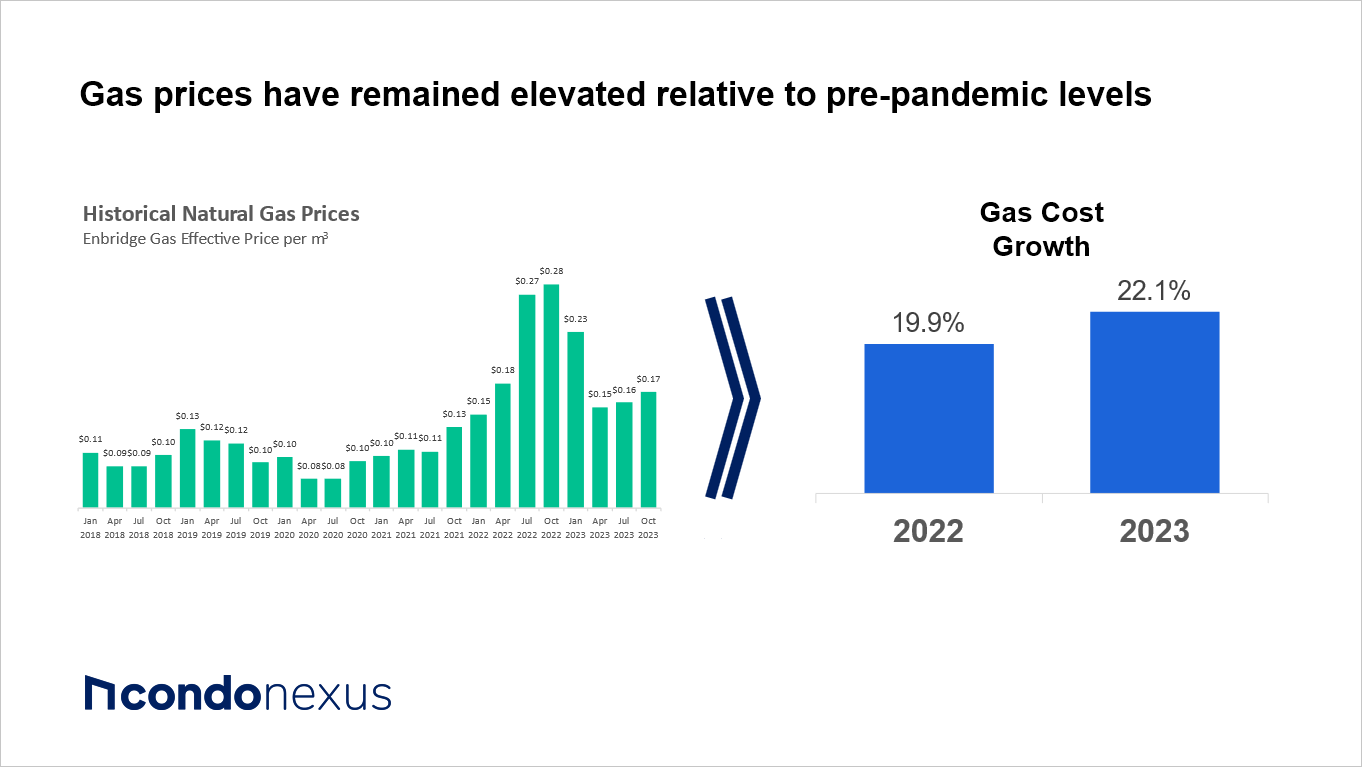

Gas Budgets Continue to See Rising Allocations

This year saw another substantial increase in gas costs, which rose 22.1% across the condos studied, and averaged a 6.7% share of an average condo’s budget. Supply and demand pressures from conflicts abroad roiled the natural gas markets in 2022, with natural gas prices more than doubling during its peak in late 2022. While gas prices have come back down since then, gas prices remain around 40% higher than average rates seen in the years pre-pandemic.

We believe the increase in gas budgets in condos in 2023 reflect both some condos further topping up gas budgets to finance the still elevated cost of gas, and other condos with earlier year-ends increasing their gas budgets more significantly after getting caught off guard by rising gas costs in late 2022.

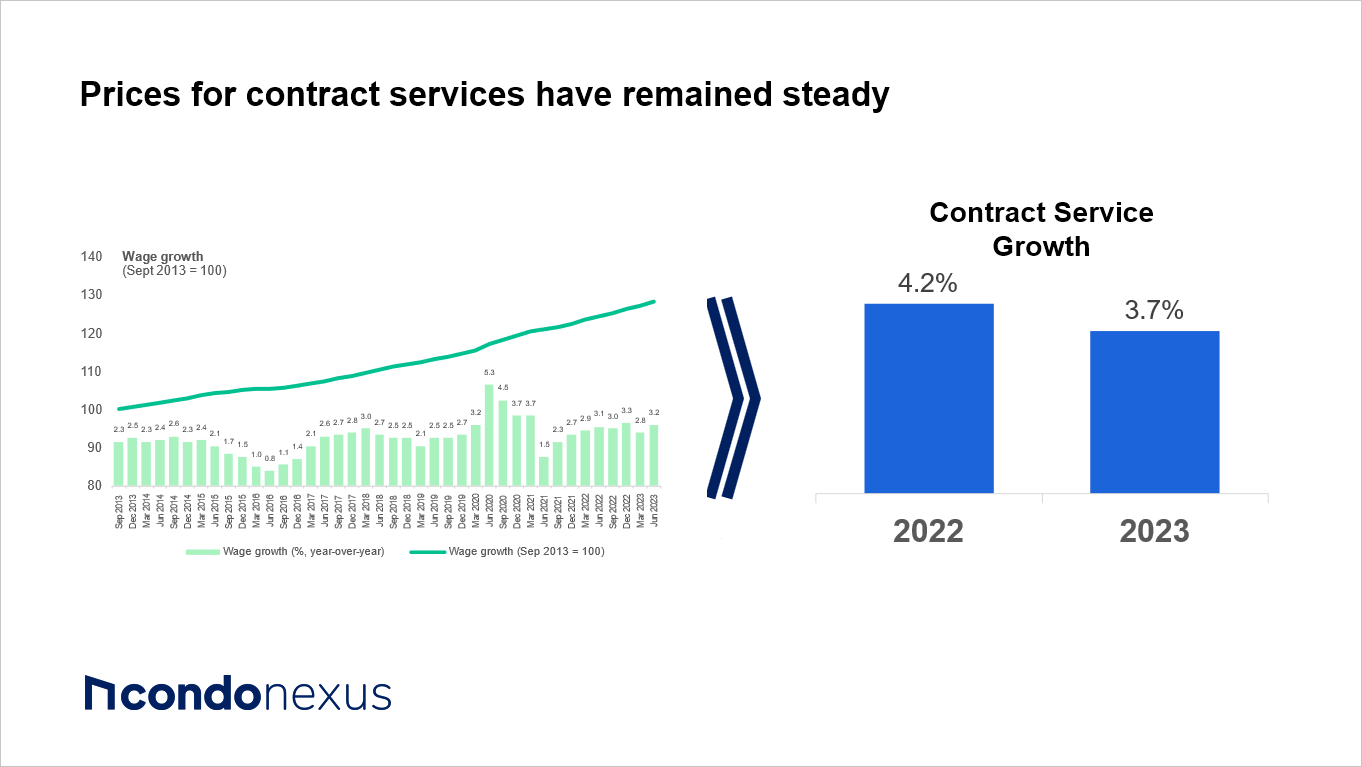

Prices for Contract Services Have Remained Steady

Condo contract service price growth remained relatively steady, increasing 3.7% year-over-year, while averaging a 27.3% allocation to a condo’s overall budget. These costs include maintenance staff, concierge staff, management fees, among other contract services.

We believe that the increase in this component remained relatively steady due to generally favorable competitive dynamics. Competition amongst suppliers remains relatively abundant, likely placing a ceiling on how fast contract service costs can grow. Moreover, the cost of labour for suppliers, which suppliers will try to pass through to condos, has remained relatively steady between 2-3% for well over a decade.

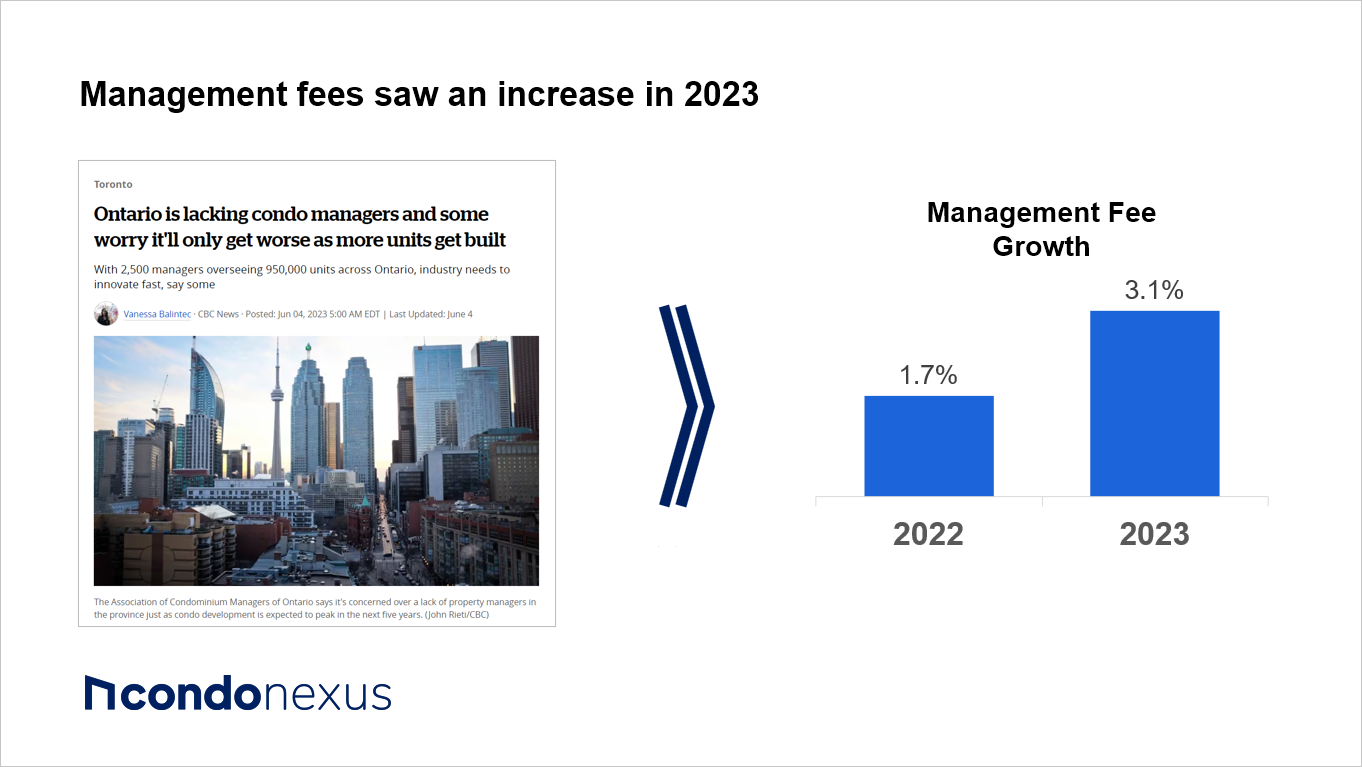

Property Management Fees Increase as Manager Shortage Continues

One area within service contracts that saw higher increases in 2023 was property management fees, which grew at 3.1% on average, compared to growing 1.7% in 2022.

The manager shortage has been widely reported in the condo industry. The shortage has meant that fewer property managers are available to fill vacancies, which has been an industry concern with the high number of new condos being built every year. Typically, resource shortages will lead to higher costs for suppliers, and in this case, could result in higher costs for recruitment, training, or wages, which we may be seeing property management companies trying to pass on to condos.

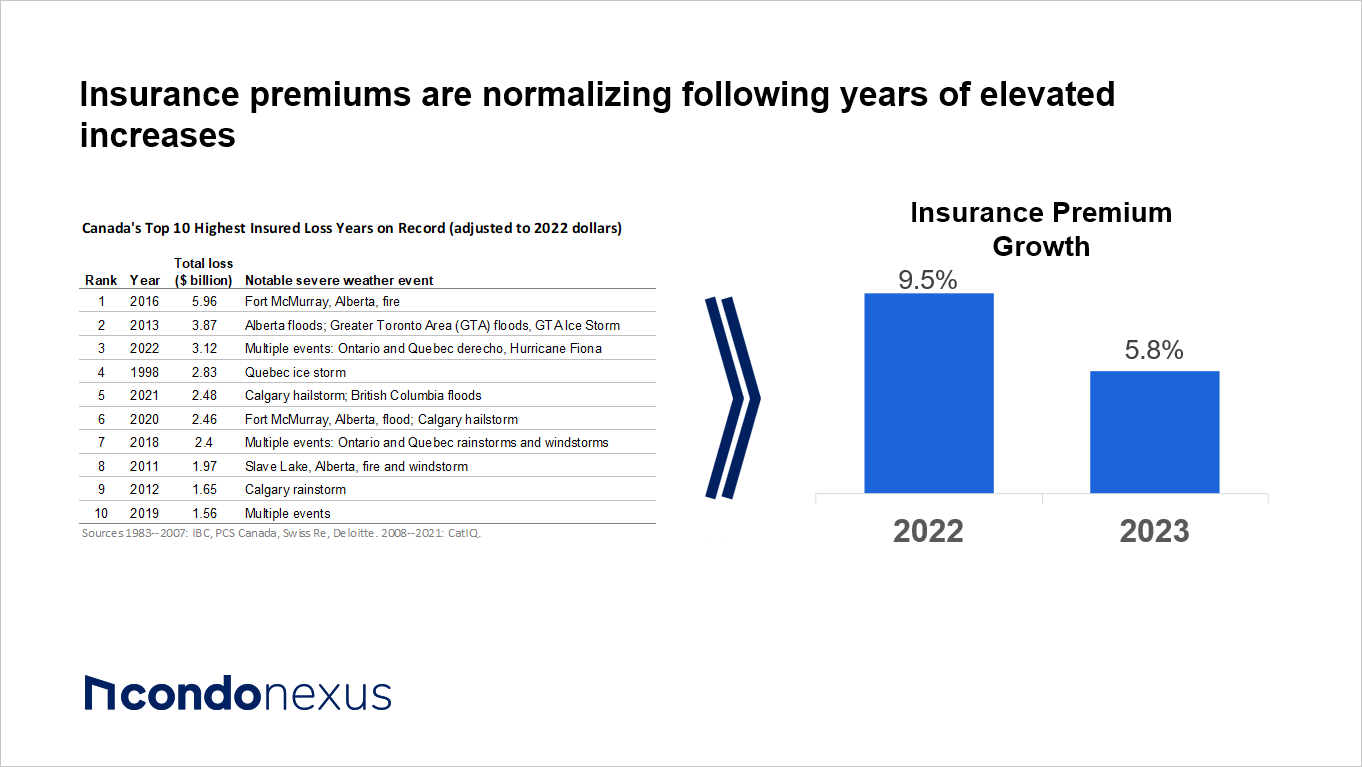

Insurance Premiums Continue to Trend Upwards

Growth in condo insurance premiums softened in 2023 to 5.8%, while averaging a 4.9% allocation to a condo’s overall budget. The condo insurance market has seen a supply shortage with many insurers leaving the market citing unprofitability due to high insured loss events. In fact, the Insurance Board of Canada reports that 9 out of the top 10 highest insured loss years on record for insurers in Canada over the last 40 years happened in the last 12 years.

Losses arising from situations like water damage, weather incidents and replacement events have been under the microscope for insurers in recent years, and insurers who have remained in the market have hiked premiums to offset their growing understanding of risk. That being said, the softening in insurance premium increases at condos from 9.5% last year to 5.8% this year may be a sign that premiums are finally starting to normalize.

Looking Forward

Overall, condo fees continue to increase in 2023 at an elevated rate compared to previous years. Large increases in major underlying components of the budget contributed largely to the overall increase in condo fees. Managers and Boards must carefully consider the key themes discussed above to ensure they adequately budget for upcoming costs in the year ahead and avoid any budget shortfalls. We hope that this guide is helpful for boards and management as they plan their budgets and communicate it to their stakeholders in the year ahead.